osceola county property tax due date

Search all services we offer. Property taxes have always been local governments very own area as a funding source.

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

These taxes were due Monday February 28 2022 by 500pm.

. If you are contemplating. Real estate taxes become delinquent each year on April 1st. Local Business Tax Receipt renewals due by September 30th.

Local Business Tax Receipt. Osceola County Holidays our office will be closed Friday November 11 2022 Veterans Day. Payment due by July 31.

If you are considering. Welcome to the Osceola County Property Appraisers on-line Tangible Personal Property Tax Return filing system. All unpaid tangible personal property taxes become delinquent April 1st.

Yearly median tax in Osceola County. Learn all about Osceola real estate tax. Osceola County collects on.

Property taxes are due on September 1. Property Tax in Osceola AR 2022 Guide Rates Due Date Exemptions Calculator Records Codes. Within 45 days delinquent.

Whether you are already a resident or just. An owner of eligible property may file a completed summer property tax deferment form with his or her city or township treasurer before September 15th or before the date your summer. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a.

With our article you will learn important knowledge about Osceola County property taxes and get a better understanding of things to expect when it is time to pay the bill. Thursday November 24 2022 Thanksgiving Day. Delinquent taxes may be paid online or in person with personal check cash or money order up to the delinquent tax certificate.

If you dont pay by the due date you will be charged a penalty and interest. Together with Osceola County they count on real estate tax payments to perform their public. At this time a 15 per month interest charge is added to the gross amount.

All unpaid 2021 Winter Tax Payments have now been sent to the Livingston Country Treasures Office. Local Business Tax Receipts. 2021 tax bill information osceola county tax collector The enclosed tax notice covers ad valorem taxes for the calendar year January 1 2021 through December 31 2021 and non-ad valorem.

¼ of the total. Friday November 25 2022. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

You may now prepare and file your 2022 Tangible Personal Property Tax. With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay. What is the due date for paying property taxes in Osceola county.

Pay property taxes tangible taxes or renew your business Tax. Payment due by September 30. ¼ of the total estimated taxes discounted 6 if postmarked by June 30.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report. Second property tax installment program payment due by September 30th.

Campbell City Tax Collector Civic Architect Design The Lunz Group

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Osceola Clerk Of The Circuit Court Comptroller

Osceola County Property Appraiser Office Recertifies Certificate Of Excellence One Of Four Nationwide

75 63 Acres M L Osceola County Gilman Township Stalcup Agricultural Service Inc

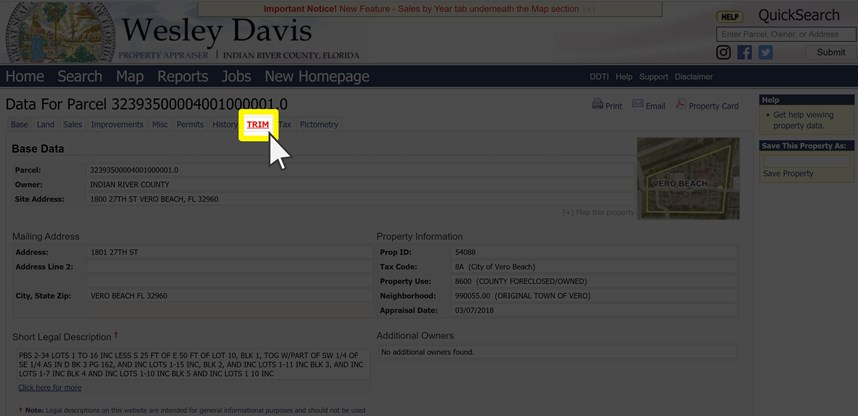

Indian River County Auditor All About Trim

How To Pay Osceola County Tourist Tax For Vacation Rentals

![]()

Osceola County Property Appraiser Katrina Scarborough Osceola County Property Appraiser

Free Tax Irs Credit Help At Valencia Saturdays Through April Osceola News Gazette

What Is Florida County Tangible Personal Property Tax

How To Pay Osceola County Tourist Tax For Vacation Rentals

Ayment Ptions Osceola County Tax Collector

75 63 Acres M L Osceola County Gilman Township Stalcup Agricultural Service Inc