pay my past due excise tax massachusetts

IF YOUR LICENSE IS SUSPENDED YOU MUST PAY WITH CASH OR MONEY ORDER Please use. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

IF YOUR LICENSE IS SUSPENDED YOU MUST PAY WITH CASH OR MONEY ORDER Please use this page to search for delinquent MOTOR VEHICLE EXCISE TAX bills.

. Pay my past due excise tax massachusetts. This information will lead you to The State. Pay past due excise tax massachusetts.

How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. If not paid pursuant to massachusetts general law chapter 60 section 15 a demand fee of 1000 will be added. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660.

Nonpayment of a bill triggers a demand bill to be produced and a demand fee of 1500 payable in 14 days. If JavaScript is disabled in your browser please. If not paid pursuant to massachusetts general law chapter 60 section 15 a demand fee of 1000 will be added.

If you still fail to pay the excise the deputy collector or collector will notify the Registrar of Motor Vehicles RMV within a 2 year period after the original excise bill was mailed. The Deputy Tax. To make a Payment By Phone 247 please call toll-free 877-415-6045.

Learn more about late payments and motor vehicle tax. Tax Department Call DOR Contact Tax Department at 617 887-6367. The tax rate is 25 for every 1000 of your vehicles value.

Schedule payment today to occur at a later time. It appears that your browser does not support JavaScript or you have it disabled. Pay past due excise tax massachusetts.

If you own or lease a vehicle in Massachusetts you will pay an excise tax each year. Pay Past Due Excise Tax Bills. If the bill goes unpaid interest accrues at 12 per annum.

Call the Taxpayer Referral and Assistance Center at 617-635-4287. How does excise tax work in Massachusetts. An excise tax needs to be paid within 30 days from the day its issued.

Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax. Pay my past due excise tax massachusetts. Bills that are more than 45 days past due are marked at the registry for non-renewal sent to the Deputy Collector and must be paid to Kelley and RyanPFRyan Deputy of.

To make a Payment By Phone 247 please call toll-free 877-415-6045. 2018 excise tax commitments unless past due. Motor Vehicle Excise Tax bills are due in 30 days.

You will need specific account information to pay by phone. Pay past due excise tax massachusetts. Please note all online payments will have a 45 processing fee added to your total due.

They also have multiple locations you can pay including. 2018 excise tax commitments unless past due. When the demand bill becomes past due the account is turned over to the Deputy Tax Collector placed on warrant.

You can pay your excise tax through our online payment system. The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle tax rate. To complete a search you must provide several pieces of information to ensure we match you to the.

Excise tax bills are owed to the citytown where the vehicletrailer was garaged as of January 1. A 10 demand fee will be charged to each bill. PAY YOUR BILL ON TIME.

Massachusetts Motor Vehicle Excise Tax Information. What happens if you dont pay your excise tax in Mass. If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill.

Pay my past due excise tax massachusetts. Have questions about your bill for the current fiscal year. Interest at a rate of 12 per annum will be charged from the due date to the date of payment.

You need to enter your last name and license plate number to find your bill. Demand bills will be issued for any excise bill not paid by the due date. Pay my past due excise tax massachusetts.

Massachusetts Mulls Tax Credit To Offset Medical Device Tax Ortho Spine News Massachusetts Map Providence Rhode Island

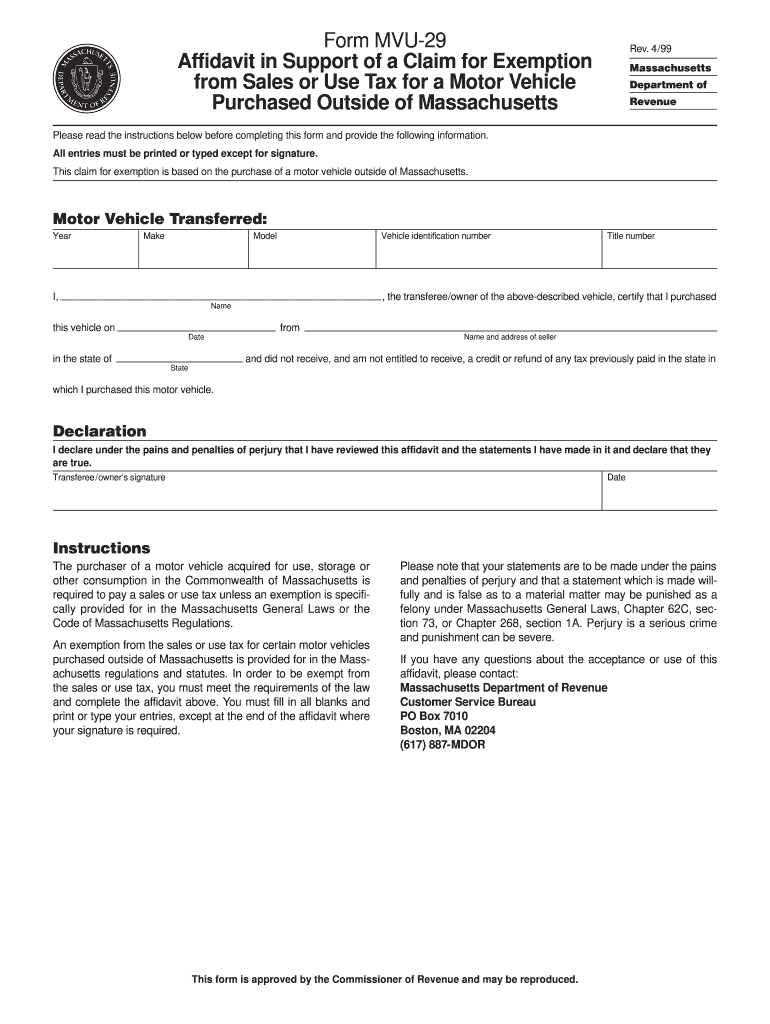

Ma Dor Mvu 29 1999 2022 Fill Out Tax Template Online Us Legal Forms

Town Of Braintree Mayor Charles C Kokoros Would Like To Inform Residents That Per Recently Signed State Legislation The Town Is Extending The Due Date For Several Categories Of Tax And

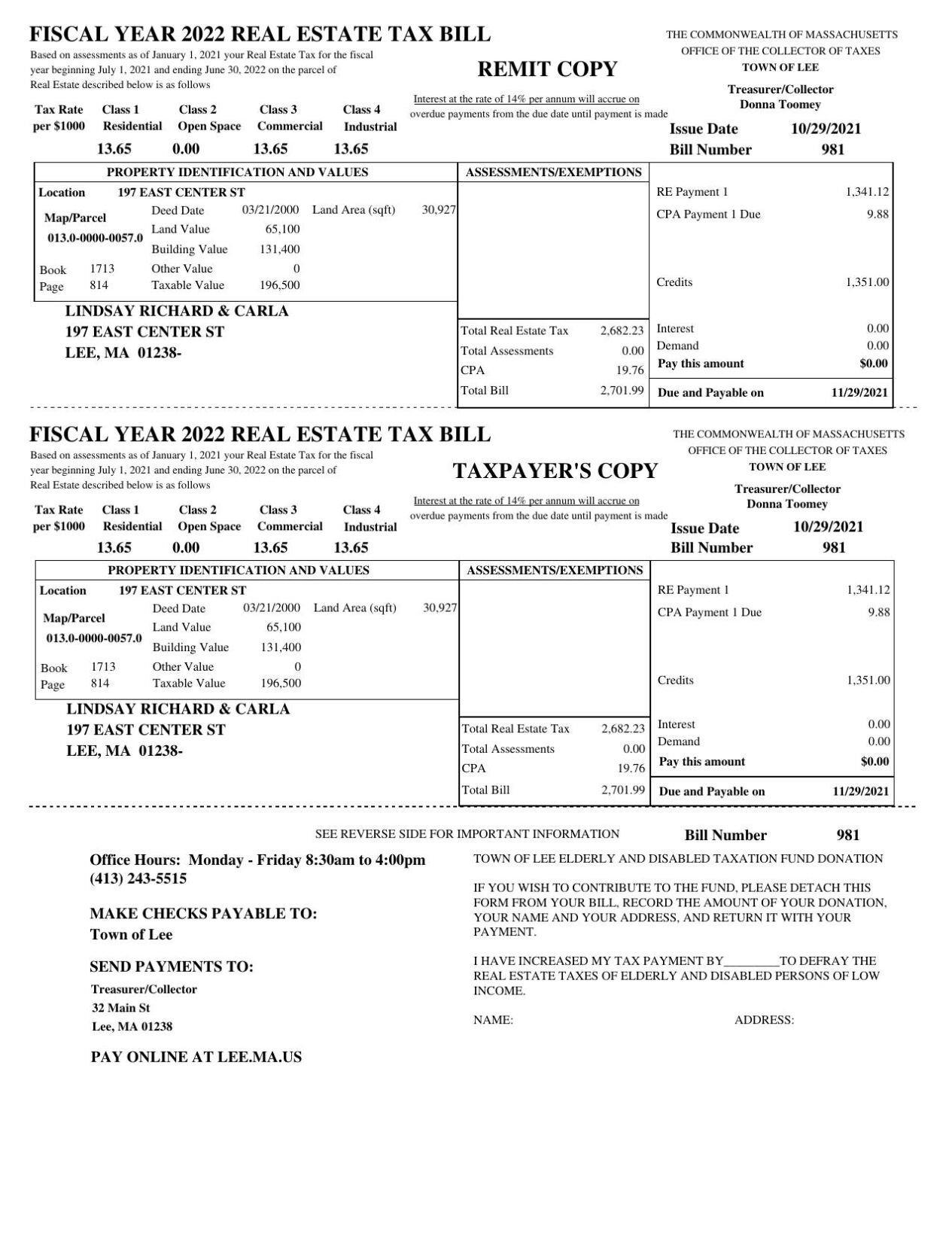

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

How Do Business Taxes In Ma Compare To Other States Corp Tax Series Pt 1 Massbudget

Who Pays Low And Middle Earners In Massachusetts Pay Larger Share Of Their Incomes In Taxes Massbudget

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

Massachusetts Enacts Elective Excise Tax For Pass Through Entities Albin Randall And Bennett

Here S How Readers Feel About The Tax Burden In Massachusetts

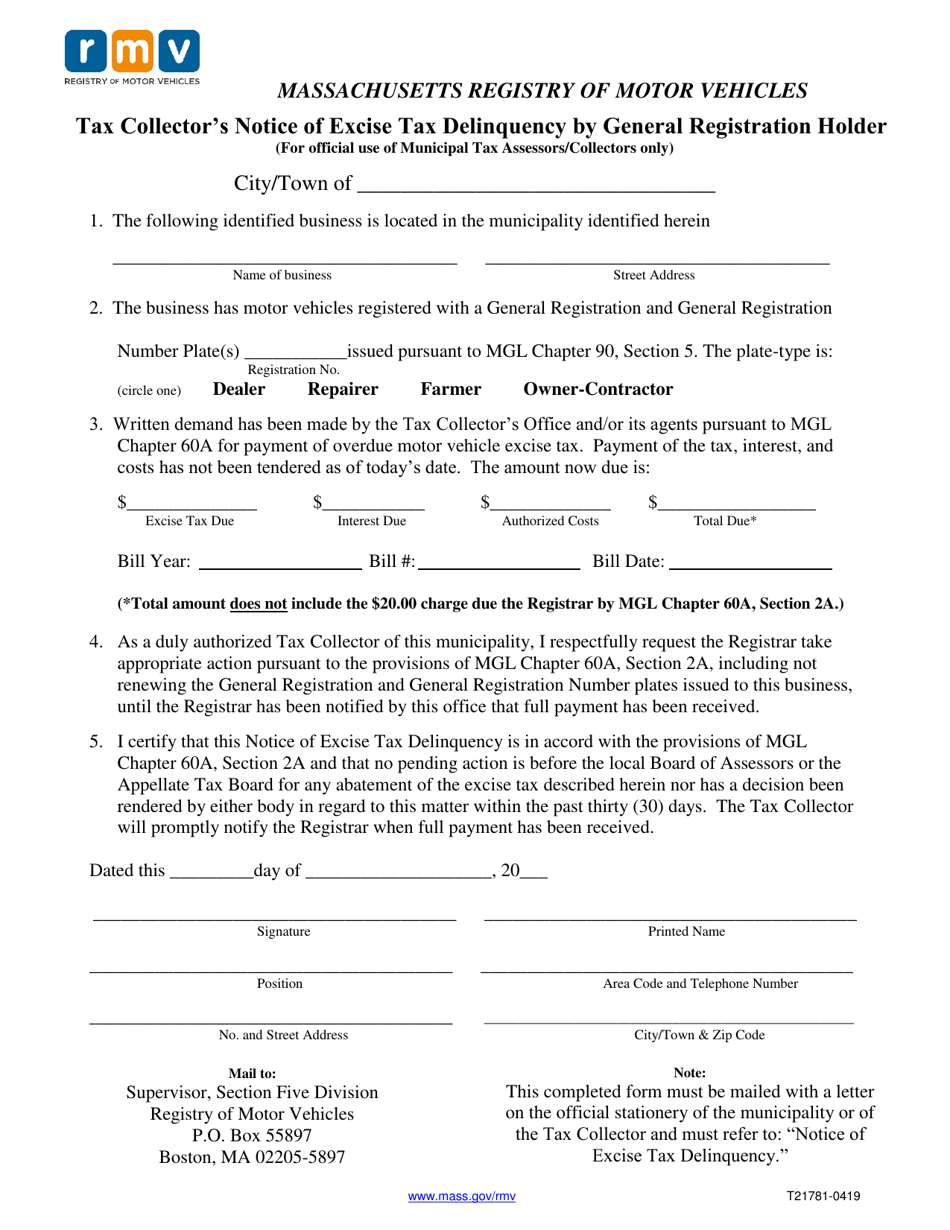

Form T21781 Download Printable Pdf Or Fill Online Tax Collector S Notice Of Excise Tax Delinquency By General Registration Holder For Official Use Of Municipal Tax Assessors Collectors Only Massachusetts Templateroller

Motor Vehicle Excise Tax Wellesley Ma

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price